AR Balance Adjustments from Account Inquiry |

Entering an AR Balance Adjustment will credit or debit the Invoice balance.

This document will take you through the steps to post an AR Balance Adjustment from Account Inquiry, illustrate the end results in the Customer Invoice, Adjustment Journal and Adjustment Listing. You will also find information to include an optional GL Account selection on adjustments. Also see Related Topics.

Navigate To: Accounting>Account Inquiry

AR Balance Adjustment

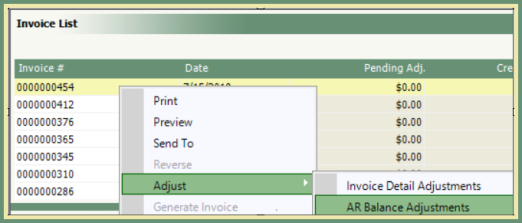

- Enter or Search Customer/Site number OR Enter Invoice number to be adjusted in the Invoice # field.

- In the Invoice List, right click on the Invoice to be adjusted.

- Select Adjust>AR Balance Adjustments.

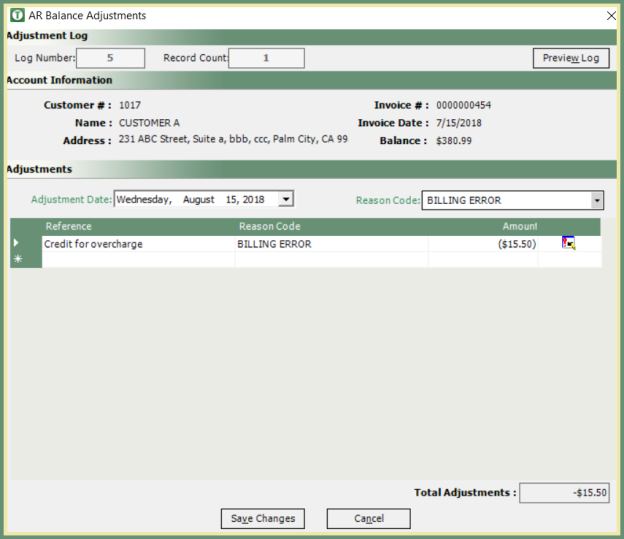

- Select the Adjustment Date and Reason Code from the drop down menu.

- Enter Reference (optional, but recommended for future reference).

- Reason Code will default to the Reason Code selected.

- Enter adjustment amount as positive or negative.

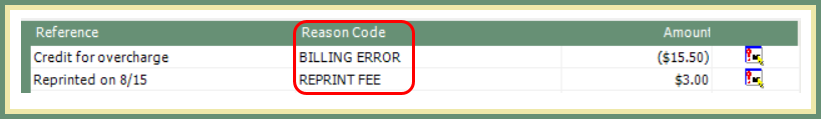

- If multiple adjustments are being entered, repeat steps 5-7. Reason Code can be changed for each adjustment line item.

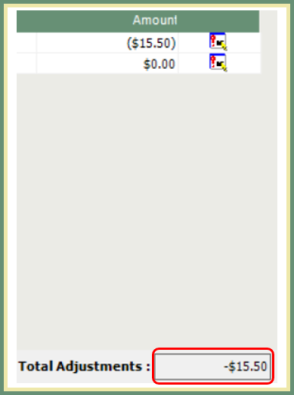

- Verify Total Adjustments.

- Save Changes.

AR Balance Adjustments with General Ledger Accounts

AR Balance Adjustments have the option to Enforce GL Account on Adjustments. Utilizing this function will force the user to make a GL Account selection for all AR Balance Adjustments. Click the above link for setup instructions.

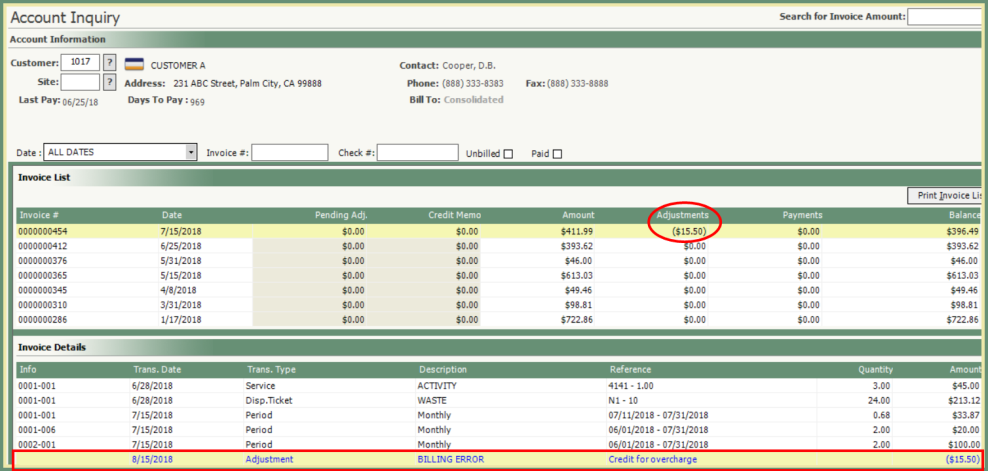

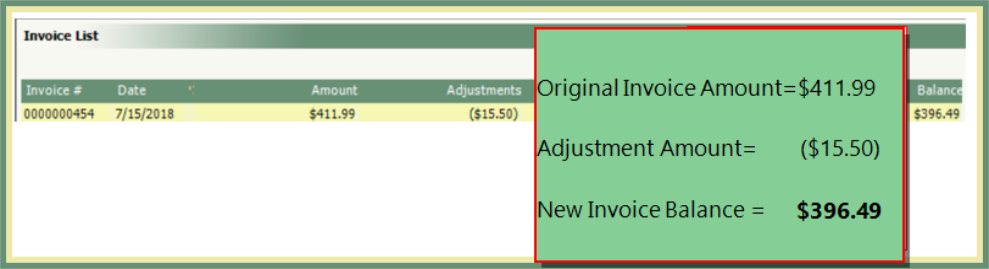

- AR Balance Adjustment will now display the adjustment in the Adjustment column and invoice balance will reflect the adjusted amount. See below.

- The Invoice Details will display the adjustment date, transaction type=Adjustment, adjustment reason, reference and amount. See below.

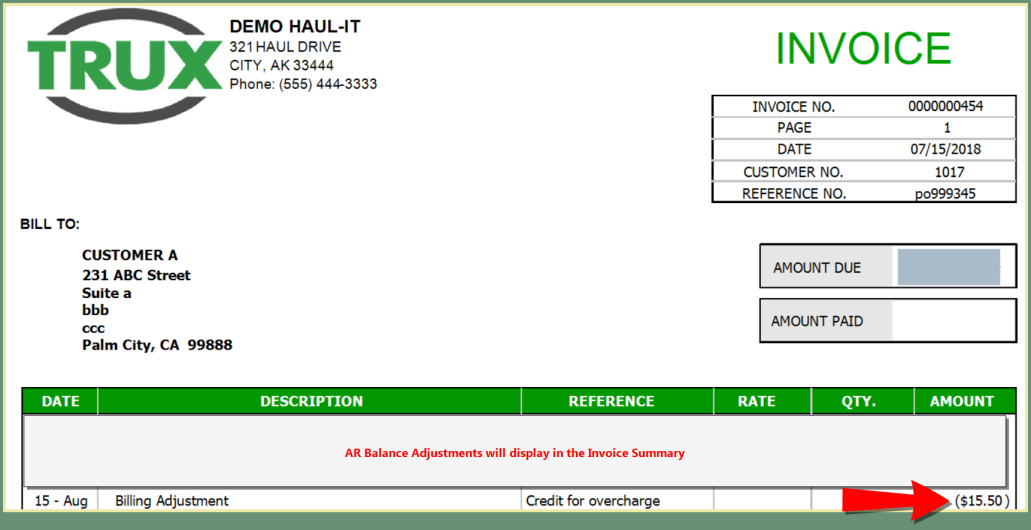

AR Balance Adjustment will be included in the Invoice Summary

Tips:

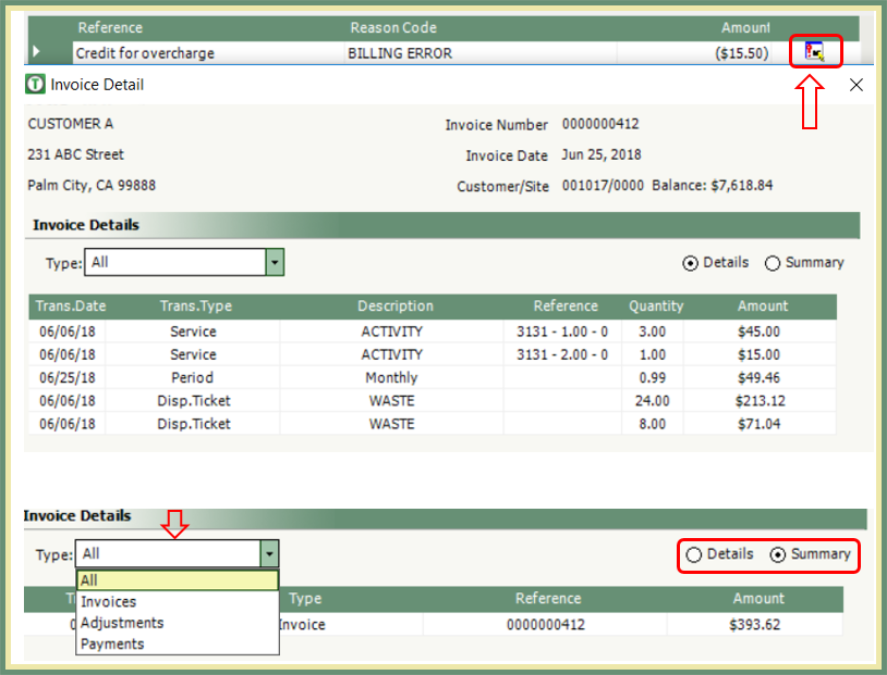

- To the right of the amount field, click the Invoice Details tool tip.

- Invoice Details can be displayed in Detail or Summary. Default is Detail. Click the Summary radio button to display in Summary.

- Invoice Detail Type can display All, Invoice, Adjustments or Payments. The default is All. Click on the Type drop down to change the display.

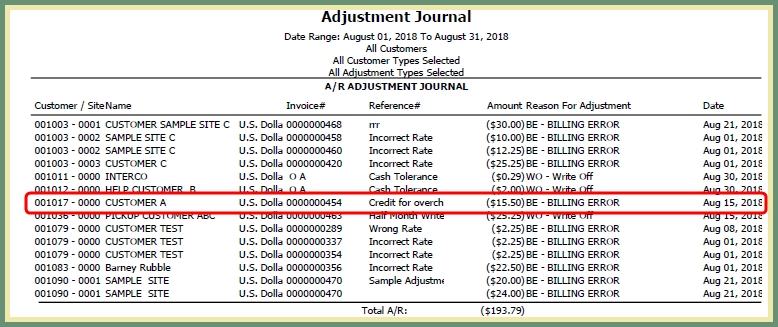

Navigate: Report>Accounting>Journals>Adjustment Journal

- Adjustment Journal is run for a Billing Period.

- Adjustments posted during the reported Billing Period will be included.

- Adjustments entered through Account Inquiry are included on the Adjustment Journal along with Adjustments entered through Post Adjustments and Batch Post Adjustments.

- The below Adjustment Journal sample is presented in Detail.

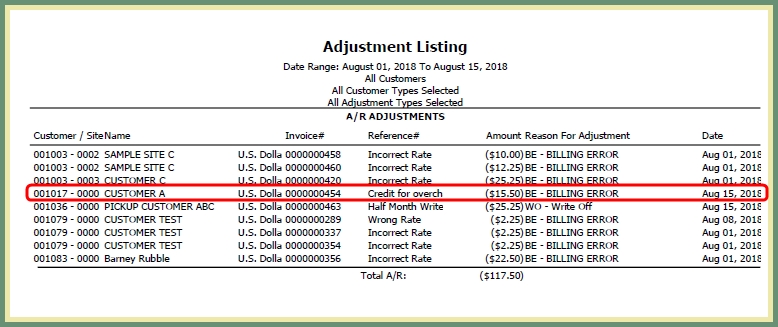

Navigate: Report>Accounting>Listing>Adjustment Listing

- Adjustment Listing is run for a Date Range.

- Adjustments posted during the selected date range will be included.

- Adjustments entered through Account Inquiry are included on the Adjustment Listing along with Adjustments entered through Post Adjustments and Batch Post Adjustments.

- The below Adjustment Listing sample is presented in Detail.